Turning Data Into Decisions: Our 2025 Freight Impact and 2026 Vision

See how we helped planners improve safety, efficiency, and data-driven decision-making in 2025 — and where we’re heading in 2026.

Freight bottlenecks don’t appear overnight — they build slowly and invisibly, long before they show up on official lists or trigger a major capital project. By the time a corridor makes an annual “top bottlenecks” ranking, the economic damage is already well underway, causing higher fuel consumption, wasted labor hours, elevated inventory carrying costs and reduced supply chain reliability.

That costs real dollars. In California alone, where Los Angeles holds the nation’s highest congestion ranking, drivers lose an estimated 100 hours per year sitting in traffic. According to the Federal Highway Administration, shoppers pay $3 more per shipment due to congestion. In our recent analysis of all 50 state freight plans, we found that 66% of states identify bottleneck mitigation as a top priority for 2026.

Fortunately, you now have access to stronger freight evidence to meet federal review standards by identifying not only current bottlenecks but emerging ones far before they become expensive problems.

When you rely on traditional bottleneck lists, the problem is often well developed before it ever appears in your official reports.

The stronger approach is to flip that model, capturing freight movement insights that reveal trouble spots earlier and help you prioritize corridors using defensible, consistent metrics that win grant approvals. Instead of reacting to congestion, you can forecast it.

You can build this early-warning system using a combination of key freight indicators, including:

Together, these metrics give you a defensible framework to rank corridors, understand root causes and select the most effective mitigation strategies.

VMT continues to be one of the most critical indicators of corridor health, and Altitude’s ongoing truck parking study with HNTB and Caltrans showcases how planners can use this granular data. Caltrans has noted that Altitude will be a valuable resource for highway calibration and validation, particularly for understanding how to reduce VMT on overloaded corridors.

By tracking VMT trends, your team can pinpoint where traffic is outpacing infrastructure and capture the early evidence needed to justify capacity upgrades or preservation projects. And because the data is corridor-specific, it can directly support competitive funding applications, including Trade Corridor Enhancement Program (TCEP) grants.

Freight often slows down significantly long before it shows up in congestion and bottleneck rankings. Speed degradation metrics reveal early bottleneck indicators by showing where freight slows down, when those slowdowns occur, whether delays are spreading or intensifying and which vehicle types are affected.

These metrics help planners distinguish between a momentary slowdown and a developing structural problem giving you a head start on mitigation before the issue surfaces in crash data or public complaints.

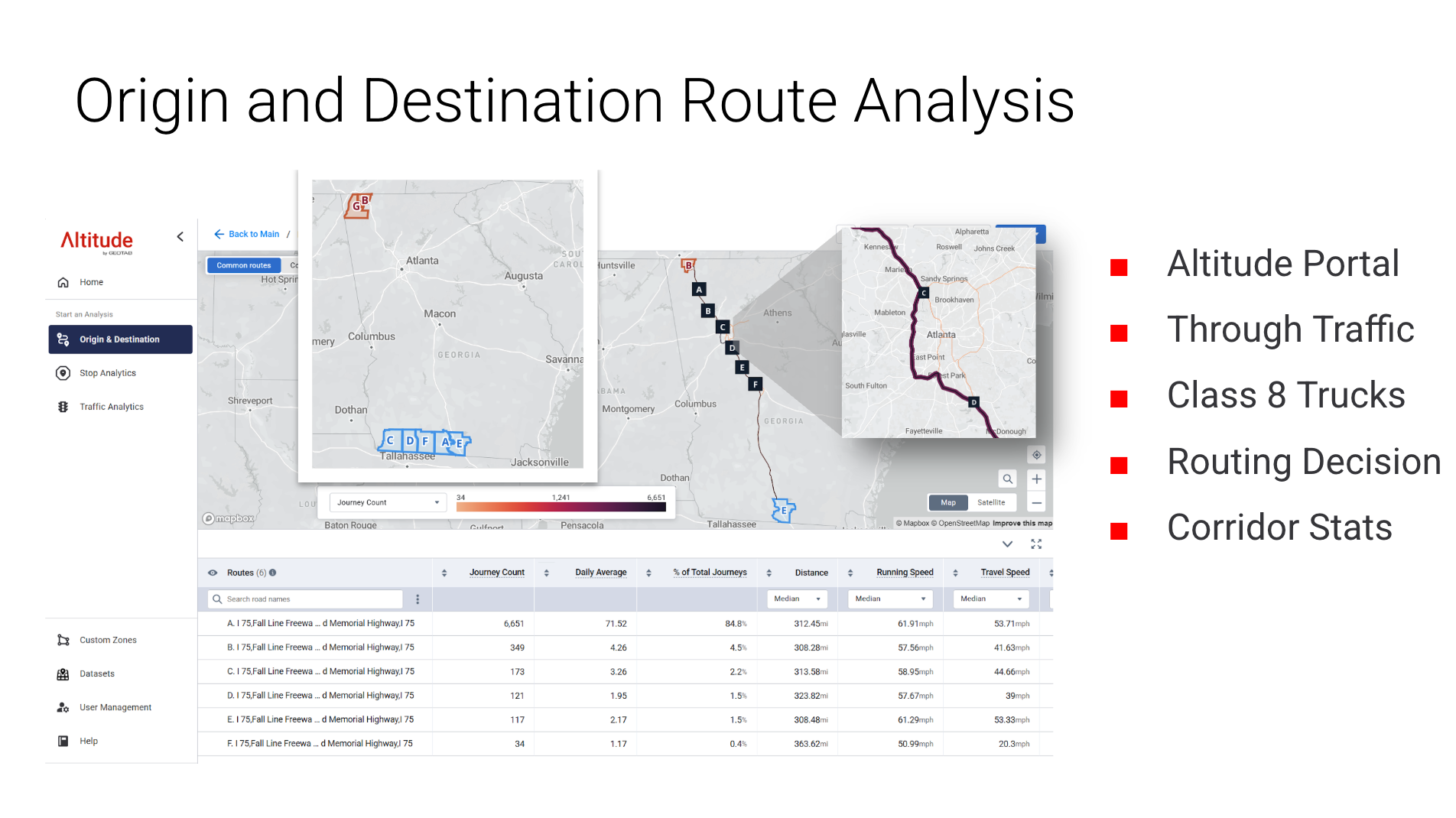

Not all congestion is caused by local freight. Altitude’s Origin & Destination analysis shows where freight ultimately begins and ends, revealing:

For example, a recent analysis of Florida’s I-75 corridor shows that most of that corridor’s long-haul freight trips bypass Atlanta by routing westward.

Figure 1: An Origin and Destination analysis of freight travel along Florida’s busy I-75 corridor reveals options for potentially shifting cargo to alternate modes.

This insight indicates that mode-shifting those trips to rail may offer a more viable relief strategy than pushing freight toward Southeastern ports including Savannah or Charleston. This is the type of actionable intelligence planners need to craft realistic multimodal solutions.

When combined for deeper analysis, the right transportation metrics do far more than diagnose congestion. They guide investment strategy. The right data helps planners:

Validated freight analytics don’t just document infrastructure challenges; they empower you to design targeted, results-focused solutions for your region. The Altitude platform gives you the clarity you need to see risks early, respond quickly and keep freight moving efficiently across the nation.

See how your state’s congestion priorities compare to the rest of the nation. We analyzed 50 state freight plans to uncover the top three challenges facing planners today: safety, infrastructure decay and congestion. Download the full eBook to see the data behind these trends and discover how validated analytics can help you design targeted, results-focused solutions for your region.

Review and download the full eBook here