For fuel retailers and truck stops, site acquisition is one of the highest-stakes decisions. It demands disciplined due diligence. A property may appear strong at first glance. Financial statements may show consistent sales, and the location may be positioned on a major highway with steady traffic. But without commercial movement insights, surface signals miss what happens on the ground.

Surface signals miss operational realities such as circulation pinch points, misaligned lane mix, or the wrong fleet profile. A site that looks profitable on paper can still hide flaws that erode long-term value.

Acquirers who rely on high-level reports risk post-close surprises, including costly redesigns and missed revenue. They discover that some properties require expensive redesigns to address circulation problems, while others struggle to meet revenue forecasts because the traditional traffic counts used to justify the purchase were incomplete. These risks are avoidable with aggregated, anonymized commercial movement insights that show how sites actually perform.

By using insights from aggregated, anonymized commercial vehicle movements, including how vehicles interact, how long they dwell, and the classes involved, investors can assess true worth. This level of commercial real estate due diligence enables site acquisition decisions based on evidence, not assumptions.

An insight-led due diligence checklist

Evaluating a property requires asking three critical questions. First, does the site’s design allow traffic to flow smoothly? Second, who are the actual customers, and what value do they bring? Third, do observed patterns scale accurately to reflect the total market? Granular movement data provides precise answers to each of these questions.

Validate site pass-bys, turn-ins, and visits before you bring an acquired site into your network

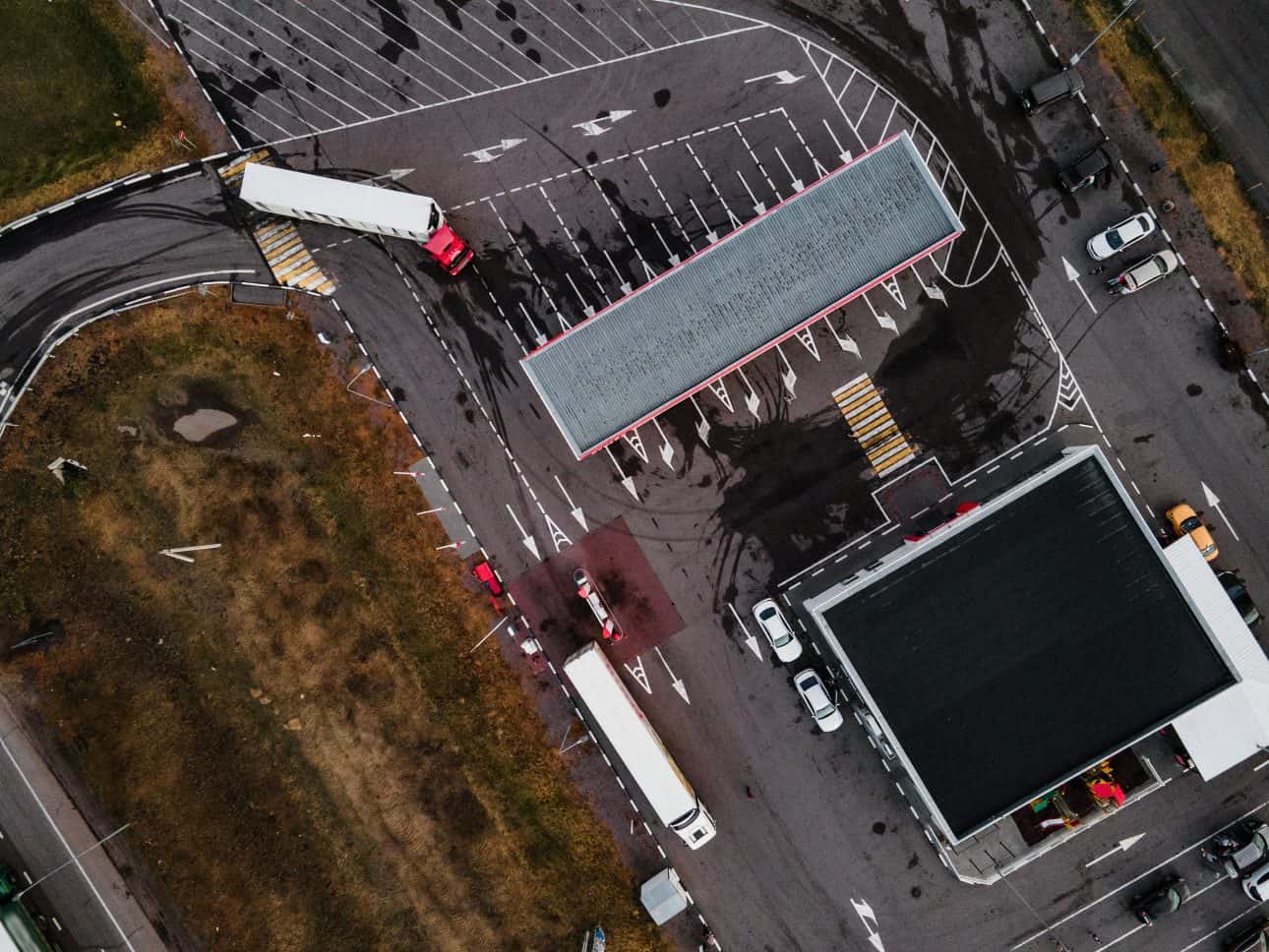

A site on a busy road may look promising, but site circulation and forecourt flow determine whether that demand converts to sales. If trucks cannot enter easily, if parking is undersized, or if canopy design creates bottlenecks, much of that demand will be lost. Circulation bottlenecks and poor forecourt flow are common weak points in properties that look strong on paper but underperform in practice.

To validate this, you need measurable circulation and flow metrics that include stop counts, dwell time, queue length, pump utilization, bypass rate, and turning-path compliance. They show whether vehicles can refuel and exit efficiently or whether design flaws create long waits and missed sales.

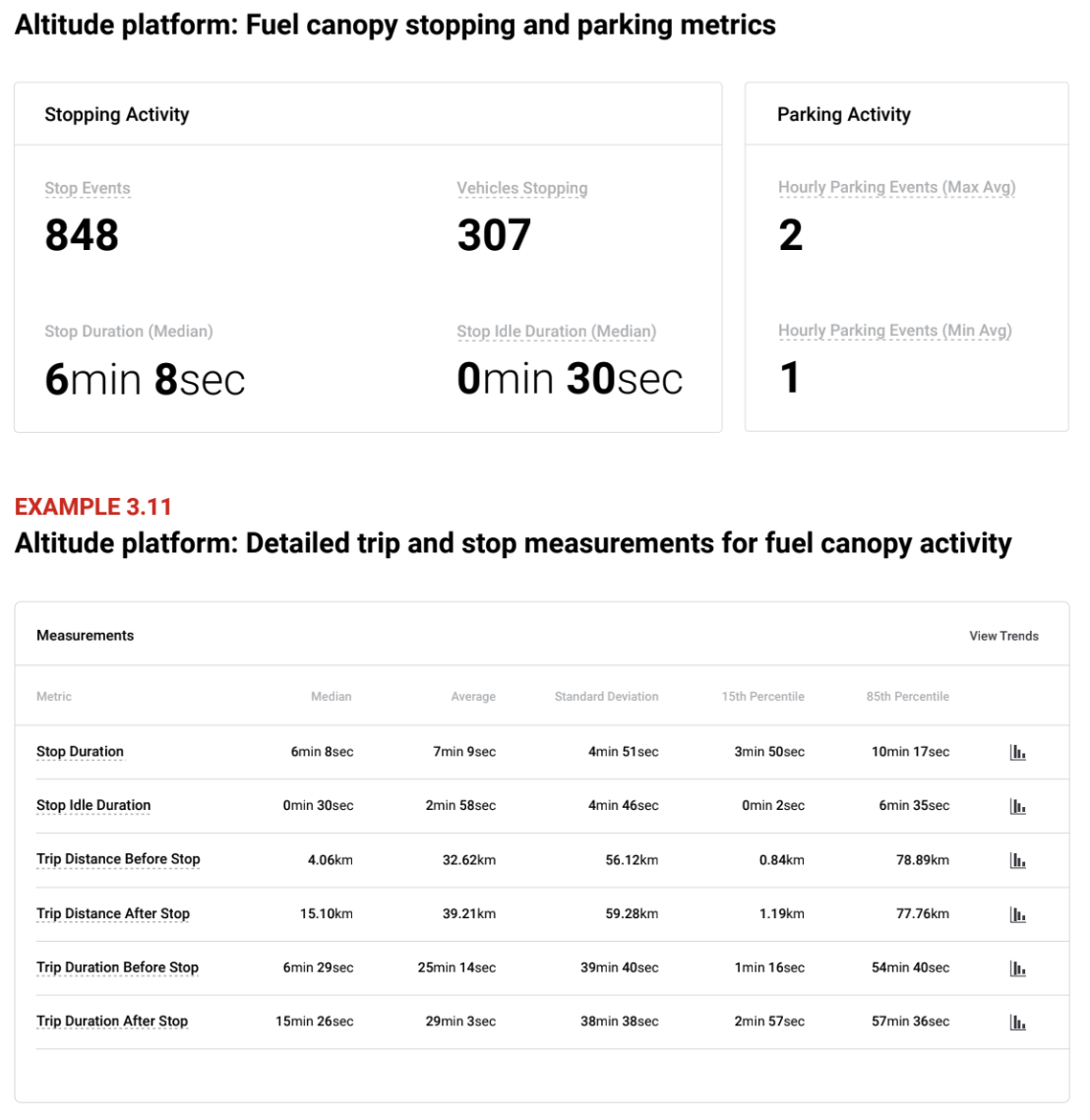

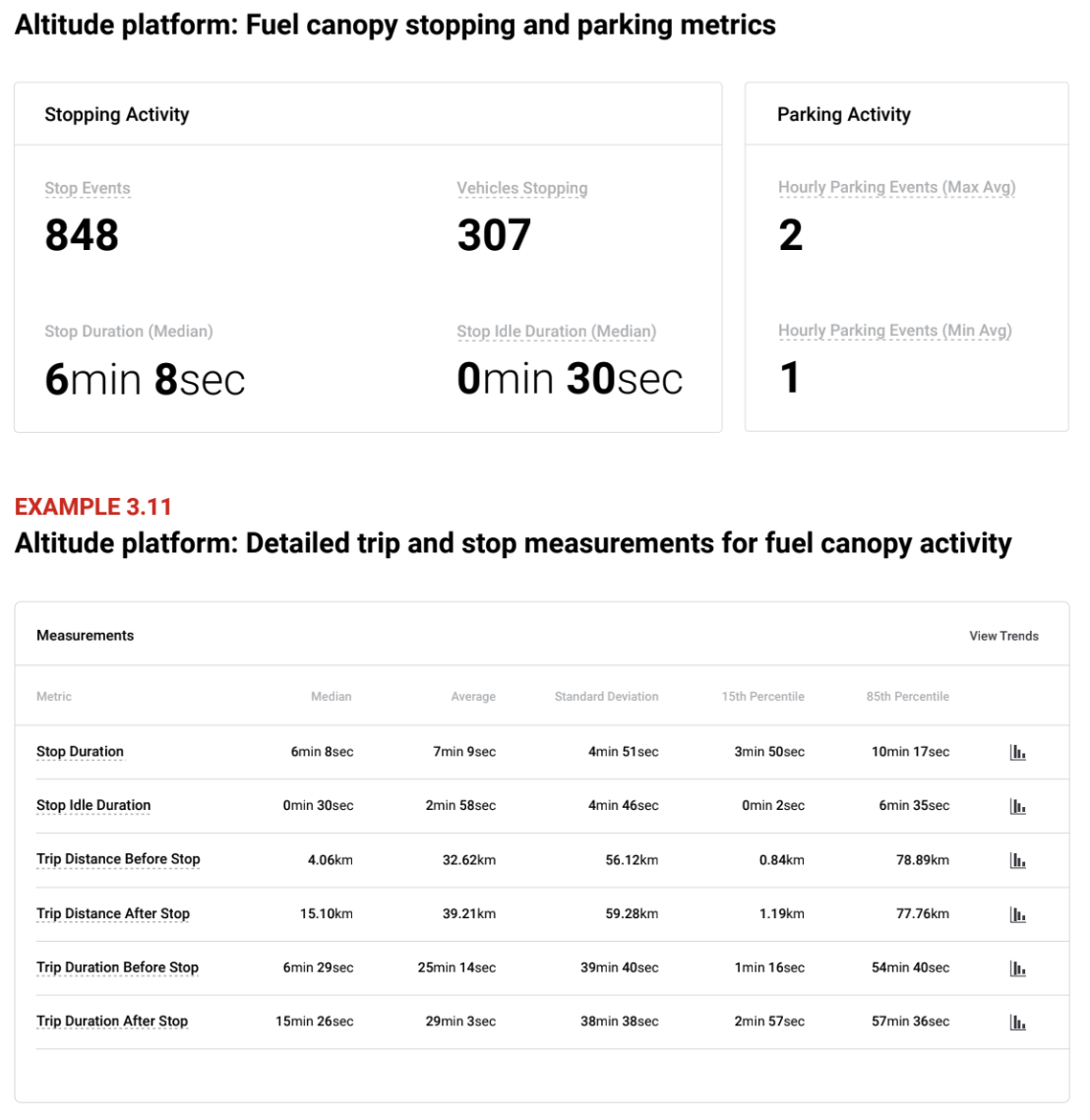

An example of this type of data can be found in a recent fuel retailer report from Altitude by Geotab, which analyzed fueling behavior at a canopy location. The study reported 848 stop events from 307 trucks with a median dwell time of 6 minutes and 8 seconds.

These measurements make site visits measurable and comparable across sites, making it possible for redesign costs to be forecasted before you buy. They provide clear insight into whether a site’s ingress, parking, and lane mix can capture passing truck demand as designed or if major upgrades will be needed immediately. By understanding these patterns in advance, operators can right-size parking, bay width, and canopy circulation before committing to construction or acquisition.

A property with strong circulation and fast forecourt flow converts passing commercial traffic into revenue. One with bottlenecks may only pencil out if redesign CapEx is priced in.

Evaluate site design based on the real commercial traffic mix

Not every customer contributes the same value or has the same needs. A heavy-duty truck filling on diesel generates far more gallons per visit than a light-duty vehicle topping up with gasoline. Long-haul drivers tend to buy meals, while light-duty drivers stick to grab-and-go items. In order to forecast revenue and plan infrastructure with confidence, you need to know the actual mix of vehicles that stop at a site.

A correct fleet mix without workable circulation or sufficient forecourt flow still underperforms. Design decisions must reconcile vehicle classes with onsite movement and throughput.

The same movement insights showed who those customers were. Of the vehicles observed, 63 percent were multi-purpose and 21 percent were light-duty trucks. Vocational insights added more detail, with nearly 30 percent of visits coming from door-to-door delivery fleets and more than 22 percent from local operators. Fuel-type analysis from observed movements showed that 85 percent of vehicles used gasoline, while only 7 percent used diesel.

Taken together, these breakdowns expose the real customer base and can help shape design priorities. They show that gasoline-powered, light-duty fleets dominated this canopy. This means efficient gasoline pumps and quick-turn convenience options should be the priority.

At a different site with a stronger heavy-duty presence, the design requirements would shift toward high-flow diesel and DEF dispensers. Amenities that support longer dwell times, such as showers, hot food, and secure parking, would also become essential.

Aligning site design with the true fleet mix is a critical part of commercial real estate due diligence. This approach allows capital to be directed to the right pumps, lanes, and amenities. It keeps investment tied to real demand while driving sustainable revenue.

Convert sample data into reliable market forecasts

Forecasting cannot rest on partial counts or anecdotal evidence. Boards and lenders expect projections that capture the full market and can withstand financial scrutiny. A week of traffic data may hint at a pattern, but it cannot justify multimillion-dollar investments. To de-risk decisions, investors need a way to scale small site samples into forecasts that reflect the true opportunity.

The Altitude platform converts observed movements into market-level insights with Expansion Factors validated against on-ground truths from the Federal Highway Administration (FHWA) permanent counters. With this method, observed stop counts can be multiplied several times over to represent the entire market while still aligning with national baselines.

Essentially, this allows a limited set of observations to become a statistically valid picture of corridor demand. The outcome is a lender-grade volume forecast that turns raw counts into actionable projections. Boards can use these numbers to approve capital, lenders can rely on them to finance deals, and M&A teams can incorporate them into network models. Instead of estimates, decisions are backed by evidence that all stakeholders trust.

By converting site samples into reliable market forecasts, investors reduce uncertainty, move projects forward faster, and limit real estate investment risk. Each decision rests on defensible data rather than assumptions, turning due diligence into a process built on proof.

Illustrating the return on investment

Commercial real estate due diligence is not just about collecting numbers. It is about building the confidence to separate strong opportunities from weak ones before capital is at risk. The right analysis helps investors avoid costly mistakes and forecast returns with accuracy. Proof is what turns site selection from a gamble into a defendable investment.

A clear ROI framework starts with risk reduction. Every acquisition carries uncertainty, but the most expensive risk is buying the wrong site. By validating fuel forecourt flow, identifying the real fleet mix, and scaling observations into market forecasts, operators gain a clear view of site performance. This shows whether a location is positioned to capture demand or whether it will require significant capital to deliver returns.

An example of site acquisition due diligence in action

Consider a retailer evaluating two potential acquisitions. The first site reports strong sales today, but data insights reveal a layout that creates long queues and frequent bypass behavior. Without redesign, its growth potential is capped and revenue will erode as competitors capture frustrated drivers.

The second site reports lower sales, but the data tells a different story. It has a balanced fleet mix, efficient circulation, and unused capacity. With targeted improvements, this site can capture more high-value traffic and grow well beyond its current performance.

The contrast highlights what raw sales figures often hide. Strong topline numbers can mask design flaws that limit growth, while modest revenue may sit on a foundation that is far more scalable. When fleet mix and circulation align, the site is positioned for sustainable returns.

This scenario shows why data-driven site acquisition due diligence is essential. By relying on measurable evidence instead of surface impressions, investors can forecast outcomes more accurately, avoid poor acquisitions, and direct capital to the sites that deliver sustainable ROI.

Use granular commercial movement insights to de-risk acquisitions

Site acquisition is one of the highest-stakes decisions in fuel retail, and surface signals alone are not enough to guide it. Traditional tools can leave investors guessing, turning a promising property into a liability. Granular movement data changes that equation by revealing how vehicles flow, who the real customers are, and how small samples scale into reliable forecasts.

This is the foundation of effective commercial real estate due diligence. It removes uncertainty, replaces assumptions with evidence, and gives boards, lenders, and operators the confidence to act. By grounding decisions in measured site circulation and forecourt flow, the real fleet mix, and validated scaling, acquirers reduce risk. They can bring existing sites into their network with eyes wide open by understanding how the asset will perform within their existing network of sites to extend access to market and increase customer loyalty.

For more information about de-risking new builds with commercial movement insights, check out the Altitude by Geotab fuel retailer report, or join us for our NACS webinar “Fueling Smarter Growth: Applying Commercial Vehicle Movement Insights to Fuel Retail & Truck Stop ROI” on Tuesday, October 28, at 02:00 PM ET.