After these types of events, planners and policymakers can equip themselves with connected traffic data analytics that detail the various traffic flows of routes before, during and after the incident. Studying route analytics enables officials to determine the types of vehicles most frequently traveling on certain roads. Leaders can also examine which alternate routes will likely be most affected, positioning them to create smarter congestion reduction strategies.

We conducted an initial analysis of the Baltimore port region after the disaster occurred, assessing its impact on widespread travel. Some of the initial results were highlighted in a recent FreightWaves article, corroborating similar trends the Federal Motor Safety Carrier Administration (FMCSA) noticed in their own data. Here are some of our study’s key findings thus far:

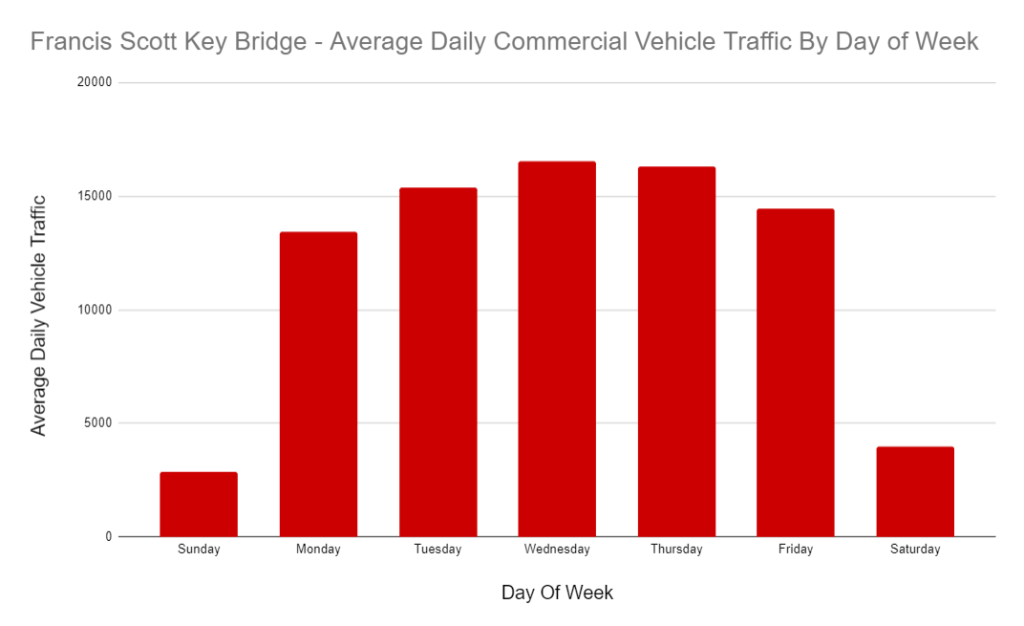

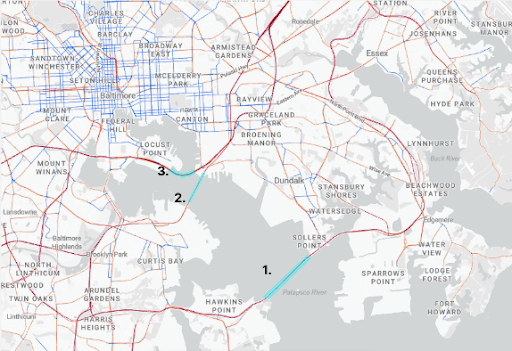

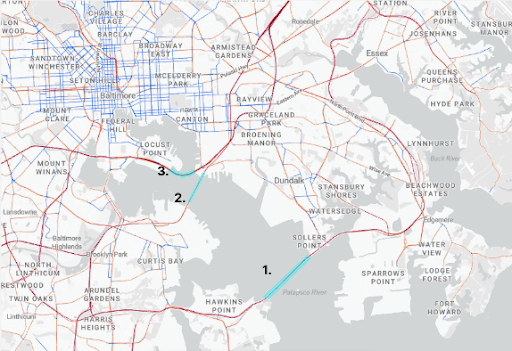

Alternative Route Effects – Our data showed that as a result of the bridge collapse, the Baltimore Harbor Tunnel and the Fort McHenry Tunnel were the two alternative routes that saw the largest traffic increases. Fort McHenry drive times increased by a range of four to 15%, while Baltimore Harbor Tunnel drive times rose by five to 24%. Prior to its collapse, the Francis Scott Key Bridge accounted for approximately 15-20% of the commercial vehicle traffic occurring on the three routes, carrying nearly double the traffic of the Baltimore Harbor Tunnel but only about one-fifth of the traffic of the Fort McHenry Tunnel.

A map of the Baltimore port region. Route 1 indicates the Francis Scott Key Bridge, Route 2 indicates the Baltimore Harbor Tunnel and Route 3 indicates the Fort McHenry Tunnel.

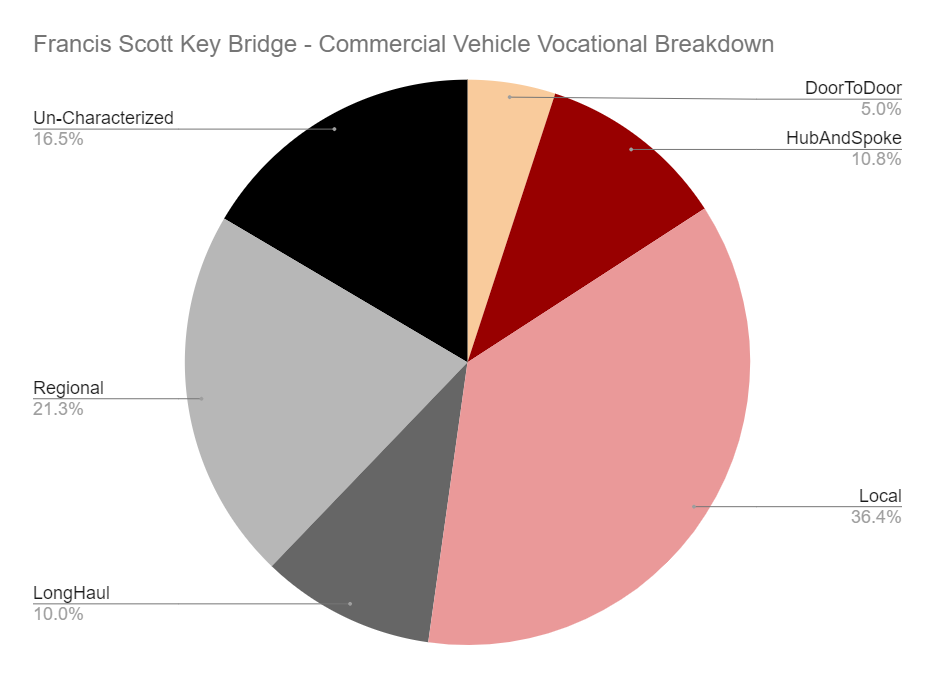

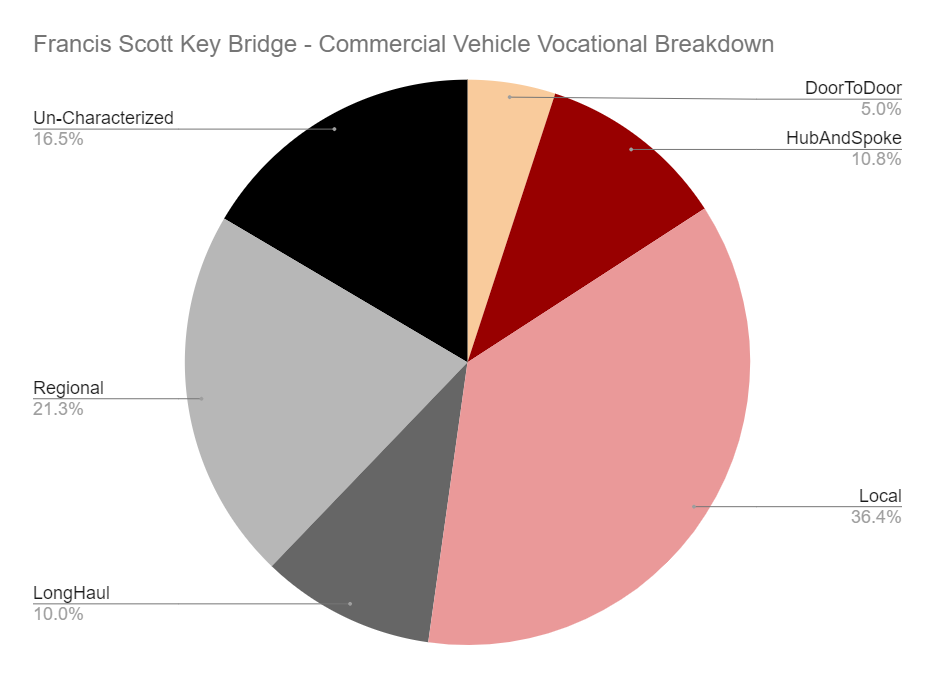

Vocational Comparisons – Across each route, trends were also observed regarding different types of vehicles. Prior to the incident, the Francis Scott Key Bridge was driven on more often by Local, Regional and Door-to-Door vocations, as was the Baltimore Harbor Tunnel. On the other hand, the Fort McHenry Tunnel saw more vehicles associated with Long-Haul jobs moving on it. After the collapse, most regional traffic diverted to each tunnel, with Long-Haul and Local traffic predominantly shifting to non-tunnel routes like Baltimore City and the Baltimore Beltway. One final trend observed was the equal division of Door-to-Door and Hub & Spoke vocations across both tunnel and non-tunnel routes.

A detailed breakdown of vehicle vocations on the Francis Scott Key bridge prior to its collapse.

Vehicle Class Comparisons – By class, our research found that vehicles most frequently traveling on the Francis Scott Key Bridge were heavy-duty trucks. The same observation was made along the Fort McHenry tunnel. Meanwhile, our data indicated that the Baltimore Harbor Tunnel’s commuters primarily were made up of multi-purpose vehicles (with fewer heavy-duty trucks).

This contextual information found using our Altitude platform provides crucial background information on the vehicles themselves. Context-added transportation data is valuable because it provides deeper insight into the overall reasons for regional vehicle movement, ultimately helping planners better understand vehicles’ diverse purposes and travel tendencies.

In addition to the near real-time contextualized traffic data, Altitude can also assist leaders with forecasting potential results after their new traffic management strategies are implemented. By helping planners model new strategies with connected vehicle data and evaluate possible results, they can create smarter traffic solutions that enhance efficiency.

Altitude by Geotab continues to monitor our data and collect new insights about the unfolding situation. Another key data category to monitor in relation to this incident is truck parking. The FMCSA is mindful of how the closure and lengthened drive times will affect commercial drivers’ parking and ability to maintain compliance. They issued an emergency declaration that provisions several exceptions and are working with the Federal Highway Administration (FHWA) to develop effective truck parking strategies in light of the incident.

With the Port of Baltimore currently being closed, it’s plausible that traffic times and congestion will continue to be adversely affected even once the port reopens. As the situation develops, Altitude by Geotab’s analysis will look out for new signs, report the data and highlight any new transportation issues that may arise.