Retail activity around the US

We analyzed commercial vehicle activity data from freight trucks, delivery vans, and other commercial vehicles in 8 different American cities over 2024. Many cities have similar patterns to each other, with a few notable exceptions that we’ll address below. Furthermore, about half (5) of the cities that we looked at have notable winter holiday peaks while the other 3 do not. The map below shows which 8 cities we assessed (Atlanta, Charlotte, Chicago, Denver, Houston, Los Angeles, New York, and Salt Lake City) as well as which cities have holiday peaks (Charlotte, Chicago, Los Angeles, New York, Salt Lake City) and which do not (Atlanta, Denver, Houston).

The map shows which 8 cities were assessed in this study (Atlanta, Charlotte, Chicago, Denver, Houston, Los Angeles, New York, and Salt Lake City) as well as which cities have holiday peaks (Charlotte, Chicago, Los Angeles, New York, Salt Lake City) and which do not (Atlanta, Denver, Houston).

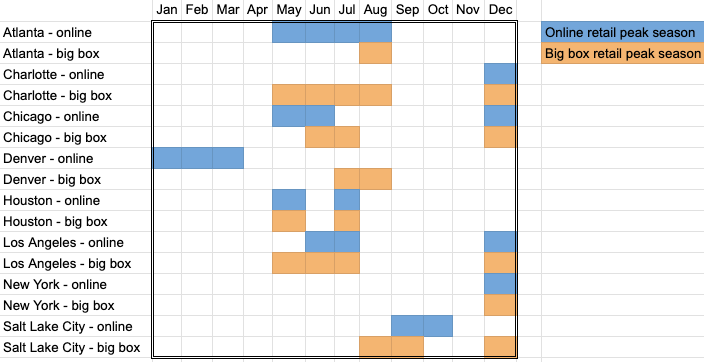

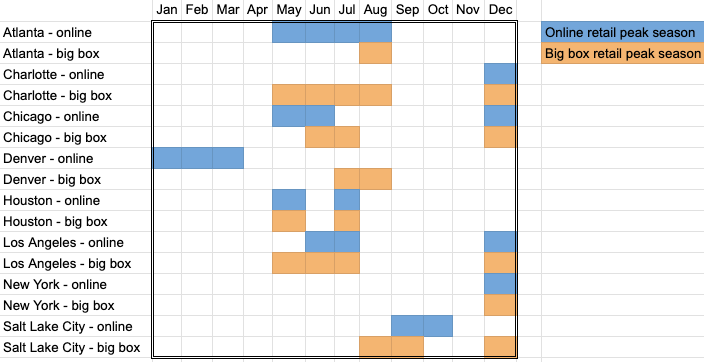

Interestingly, outside of the winter holidays, many of the cities have similar peak periods for both online and big box retail which tend to fall between May and August. Salt Lake City and Denver are the exceptions to this pattern. Salt Lake City has a big box retail peak in August and September and an online peak in September and October. Meanwhile, Denver has an online peak between January and March. The activity in Salt Lake City and Denver may be attributable to winter ski seasons which are popular in both locations. The big box retail peak periods in August in some cities may be partially attributable to college students, who are a particularly large part of the population in Salt Lake City and Atlanta.

The plot shows when online and big box retail peak periods occurred by month in 2024 in each of the 8 cities that were assessed.