Super Bowl LX Traffic Impact: How America’s Biggest Game Affects Urban Mobility

A data-driven analysis of commercial vehicle traffic patterns in San Francisco and Santa Clara during Super Bowl LIX.

In Geotab Connect’s “What to Do About the Electrification of North America’s Commercial Fleet” session, Nate Veeh, Dave Mullaney, Jawahar Shah, and Erin Sowerby brought unique perspectives on where infrastructure needs to head with the anticipation of more electrified medium and heavy-duty trucks on the road. They talked about how the nationwide trend of sustainable commercial transportation calls for strategic plans to develop new electrification infrastructure. With Altitude by Geotab insights and keen analyses of vehicle data, our cities and states can be reshaped to support sustainable freight movement systems, giving more companies the opportunity to electrify their fleet vehicles.

Mullaney of RMI discussed how certain market segments can be more easily switched to electric vehicles. Citing the food service industry in particular, he mentioned how following standardized routes each day and having lengthy stop durations overnight makes this industry segment a prime candidate for fleet electrification. As new markets like this pursue EVs, it’s critical to understand the ramifications of this for the current grid and use data to scale EV infrastructure at a manageable pace.

But it doesn’t end with food. RMI’s research, along with Altitude by Geotab’s data, indicated how certain electric vehicles can potentially eclipse 1,000-mile days with the right infrastructure solutions in place to charge their vehicles. However, these high-powered charging stations could also end up putting a strain on a region’s power grid in terms of both price and availability if enough electric heavy-duty trucks were on the road. That’s why looking at the data beforehand is so critical. What percentage of trucks are even able to be electrified? What type of chargers will they use? When will they charge? What power draws will charging create? This is a crucial question in determining how much power is needed for truck charging, and then rolling out a phased approach to EV infrastructure.

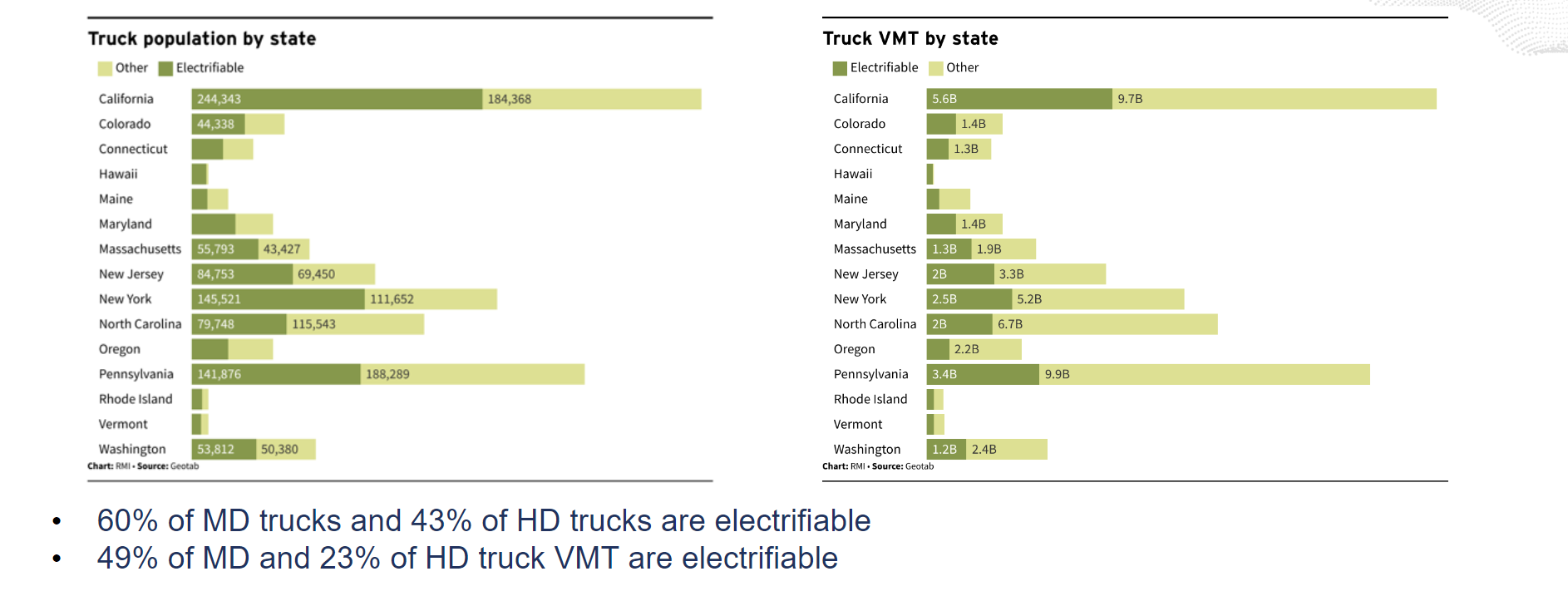

Chart demonstrating the total percentage of trucks able to become electrified, courtesy of RMI (sourced by Altitude by Geotab).

Assessing whether or not a new charging area is feasible prior to building it using analytics can save time, money and resources and position the project for success. In addition, analyzing how the grid would fare if everything were to go electric all at once is key to understanding potential shortcomings ahead of time. Knowing these pitfalls beforehand allows departments to plan EV public charging options at a scalable rate.

Mullaney spoke about how the evaluation process for EV infrastructure suitability should also factor in charging windows and energy requirements before investments in the grid are made. Forecasting the potential rewards of those investments is also important in determining how to first begin scaling electric vehicle infrastructure.

Tangible examples were provided of how planners in different regions of the U.S. can study metrics like average travel distance and the total wattage needed to inform investment needs. Geotab’s ITS insights are versatile and allow for virtually any area to be studied using advanced tools like stop clustering and customizable zoning. Investing in sustainable transportation equipment with the power of Geotab’s data helps enhance fuel efficiency and overall public health.

RMI also worked with Altitude by Geotab to deploy their electric trucking dashboard with rich, accurate transportation data. Using our insights, they were able to estimate how many trucks could be replaced with electric vehicles in every county subject to the Advanced Clean Truck rule – with a focus on LA as a case study and epicenter of electric truck adoption. State planners are able to use this information to assess the total possible market for commercial truck electrification, helping them prepare the grid for smartly placed sustainable infrastructure. By looking at total energy needs, commercial vehicle travel and which types of trucks can be electrified, officials can make transportation decisions that support a cleaner environment.

Drayage trucks, or heavy trucks that usually transport large shipping containers for sea vessels, also have the potential to be electrified. Another use case with RMI and our data demonstrated how our Stop Analytics and Origin and Destination freight insights could show where drayage truck charging stations should be placed. By looking at where these vehicles were frequently going and where they stopped most often, planners would have a better idea of where to plant new electric truck charging stations. With smarter drayage truck charging infrastructure, charger unavailability, high congestion and excessive carbon emissions could all be reduced. The study using our data indicated that putting these charging stations further away from ports would be the best option to improve regional travel and help support more freight fleets in going electric.

The North American commercial fleet remains firmly on a path to electrification. In addition to reducing company fleet costs, carbon emissions, and overpopulated fuel stations, sustainable freight movement is key to the construction of more livable cities. Our Connect session with RMI outlined crucial action items as a result of commercial fleet electrification and how important data is to successful outcomes.

Discover more about how our Altitude insights facilitate infrastructure that’s ready to meet the needs of emerging electric fleets by booking a free demo today.